United States Securities and Exchange Commission

Washington, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

Pursuant to Rule 14a-103

United States Securities and Exchange Commission

Washington, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

Pursuant to Rule 14a-103

Name of the Registrant: Dollar Tree Inc.

Name of persons relying on exemption: United Church Funds

Address of persons relying on exemption:

Written materials are submitted pursuant to Rule 14a-6(g) (1) promulgated under the Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule but is made voluntarily in the interest of public disclosure and consideration of these important issues.

Balancing Employee Wellbeing and Financial Returns: A Rebuttal to the Dollar Tree Board

We urge shareholders to vote “FOR” Item 5 of the DOLLAR TREE proxy

The Proposal asks for a report on the extent to which Dollar Tree, in designing its employee remuneration and benefits policies, is harming the financial performance of long-term diversified investors:

RESOLVED, shareholders ask that the board commission and publish a report on (1) whether the Company participates in compensation and workforce practices that prioritize Company financial performance over the economic and social costs and risks created by inequality and racial and gender disparities and (2) the manner in which any such costs and risks threaten returns of diversified shareholders who rely on a stable and productive economy.

For the diversified investors who make up a large portion of Dollar Tree shareholders, the cost of a financially insecure labor force and attendant inequality and racial disparity may very well outweigh any profits Dollar Tree receives from paying less than a living wage. The Proposal asks Dollar Tree to report on these competing interests so that shareholders can evaluate the risks involved in these compensation practices.

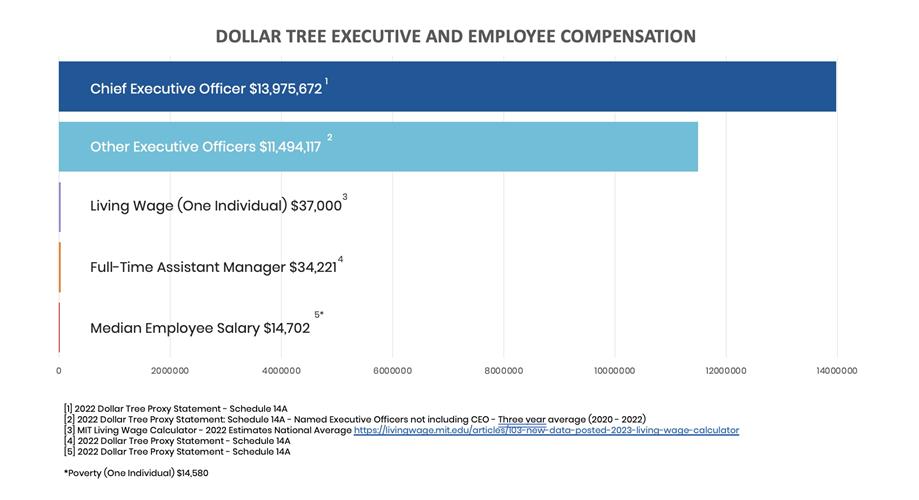

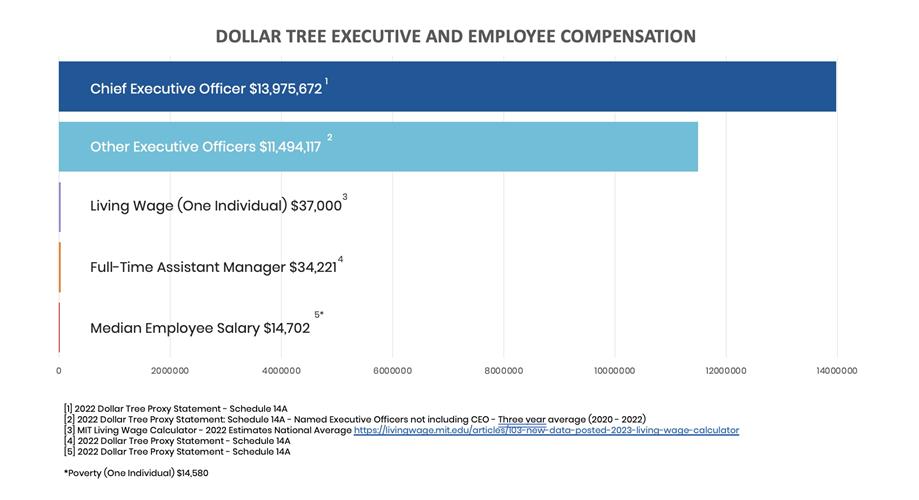

Concerning INEQUALITY EXHIBITED IN DOLLAR TREE’S COMPENSATION PRACTICE

Dollar Tree reports that its CEO earned $13,975,672 in 2022 and that its median employee earned $14,702. According to the U.S. Department of Labor’s Bureau of Labor Statistics, Dollar Tree’s median employee salary ($14,702) is in the bottom 10 percent of workers categorized as either “retail salespersons” or “cashiers.”1 The CEO-to-median worker pay ratio is reported at 951:1. In its proxy statement, Dollar Tree contends that a more appropriate ratio is to compare CEO pay to its full-time employees, since its part-time employee base is so large that it drags down the median salary. But even when you look at full-time employees, Dollar Tree’s median salary is only $34,221, and the CEO to full-time worker ratio is still a concerning 408:1.

The CEO is not the only employee earning such staggering amounts. In 2022, Dollar Tree provided its Executive Chairman with stock options that were valued at an eye-popping $135,583,212. When comparing this Chairman’s compensation with median employee pay, the ratio is 9,222:1. As the stock options were part of a one-time grant to induce Richard Dreiling to join the Dollar Tree Board as Chaiman and now CEO “by any means necessary,” we also calculated a three-year average of executive pay for the seven named executive officers (NEOs) paid substantial sums, but not including the principal or CEO. This group includes Richard Dreiling as well as Dollar Tree’s CFO, COO and other top leaders. Between 2020 and 2022, these NEOs earned $11,494,117 per year on average. When compared to the median full-time salary of a Dollar Tree worker, this ratio is 336:1.

_____________________________

1 https://www.bls.gov/oes/tables.htm

| 2 |

Racial and Gender disparity at Dollar Tree

Dollar Tree reports that of its 391 associates who are at the top level of the company (Officer and Director Level), 81.6% are white, and 75.2% are male. Comparatively, when looking at Dollar Tree’s overall workforce of 206,360 associates, only 44.8% are white, and 32.2% are male2. This suggests that those who enjoy the fruits of Dollar Tree’s top-level pay packages are predominately white males, and those who receive the least from Dollar Tree’s compensation practices are predominately women of color.

dollar Tree fails to pay a living wage

Dollar Tree does not have a minimum wage commitment, let alone a living wage commitment. Many competing retailers have made minimum wage commitments. Walmart has committed to $14 per hour3, while other retailers – including Target, Best Buy, Amazon, and Costco – have all committed to at least $15 per hour4.

Dollar Tree’s disclosure of average and starting associate wages in different regions is lagging, leading investors to rely on third-party job boards to gather these important figures. The employment website Indeed reports that Dollar Tree cashiers earn $11.87 on average across all stores5. Payscale reports that entry-level positions at Dollar Tree pay hourly ranges from $7.98 to $15.356. These differences in pay are due in part to state laws around minimum wage. Twenty states follow the federal guidelines for minimum wage of $7.25, while the state of Washington has the highest minimum wage of $15.74. This means that Dollar Tree stocking associates and cashiers in Alabama and Louisiana, which lack a state minimum wage law, can earn half as much as other employees in Massachusetts and Washington, where state minimum wages are set at $15+ per hour7. We know that Dollar Tree intentionally pays minimum wages, because its proxy statement lists increases in the minimum wage laws in states as a risk to corporate profits.

Dollar Tree’s starting wages for its lowest paid workers fall well below a living wage. The living wage model reflects “the minimum employment earnings necessary to meet a family’s basic needs while also maintaining self-sufficiency.”8 The living wage is abstemious, making no allowances for savings, consumption of even modest prepared foods or home purchases, among other basic expenses. As the MIT Living Wage Calculator explains:

The living wage is the minimum income standard that, if met, draws a very fine line between the financial independence of the working poor and the need to seek out public assistance or suffer consistent and severe housing and food insecurity. In light of this fact, the living wage is perhaps better defined as a minimum subsistence wage for persons living in the United States.9

_____________________________

2 https://corporate.dollartree.com/_assets/_2887c8708450491011bd139ee46c6fe0/dollartreeinfo/db/1177/9112/pdf/Corporate_Sustainability_Report.pdf

3 https://www.nbcnews.com/business/business-news/walmart-raise-hourly-wage-how-much-and-where-rcna67213

4 https://fox8.com/news/10-companies-that-pay-workers-15-or-more/

5 https://www.indeed.com/cmp/Dollar-Tree/salaries

6 https://www.payscale.com/research/US/Employer=Dollar_Tree_Stores_Inc/Hourly_Rate

7 https://www.epi.org/minimum-wage-tracker/

8 https://livingwage.mit.edu/pages/about (Living wage is a “market-based approach that draws upon geographically specific expenditure data related to a family’s likely minimum food, childcare, health insurance, housing, transportation, and other basic necessities (e.g. clothing, personal care items, etc.) costs. The living wage draws on these cost elements and the rough effects of income and payroll taxes to determine the minimum employment earnings necessary to meet a family’s basic needs while also maintaining self-sufficiency.”)

9 Ibid.

| 3 |

Dollar Tree’s stores are often located in rural and urban areas, where the cost of living may be lower than national averages. Noting that, we provide in the following table the 2022 living wage10 for selected Dollar Tree store locations and compare to active job openings posted on Indeed for the position of Customer Service Representative, which carries the duties of unloading new merchandise, stocking shelves, greeting customers and cashiering:

| Store Location |

Living wage: 1 adult, 0 children Annual Salary |

Dollar Tree Advertised Salary for Customer Service Representative |

| Jackson, MS | $36,745 | $21,600 - $27,30011 |

| Clayton, NJ | $36,027 | $23,400 - $29,60012 |

| Orofino, ID | $32,466 | $21,500 - $27,20013 |

| Austin, TX | $37,754 | $21,900 - $27,70014 |

| Manchester, NH | $36,549 | $21,900 - $27,80015 |

This living wage model only considers self-sufficiency (1 adult, 0 children). Adding children or other family members that need support to the household only compounds the gap between a living wage and Dollar Tree’s compensation. Dollar Tree’s starting pay is deeply inadequate no matter the employee’s location or family situation.

Economic Inequality is a risk for Investors

| 1. | Investors must diversify to optimize their portfolios. |

It is commonly understood that investors are best served by diversifying their portfolios.16 Diversification allows investors to reap the increased returns available from risky securities while greatly reducing that risk.17 This core principle is reflected in federal law, which requires fiduciaries of federally regulated retirement plans to “diversify[] the investments of the plan.”18 Similar principles govern other investment fiduciaries.19

_____________________________

10 See MIT’s Living Wage Calculator at https://livingwage.mit.edu/

11 https://www.indeed.com/q-dollar-tree-l-Jackson,-MS-jobs.html?vjk=77c8994d95533c10

12 https://www.indeed.com/jobs?q=dollar+tree&l=Clayton%2C+NJ&sc=0fcckey%3A7d2afaa40240a56a%2Cq%3A%3B&vjk=22d82ec8b45118ce

13 https://www.indeed.com/jobs?q=dollar+tree&l=Deary%2C+ID&sc=0fcckey%3A7d2afaa40240a56a%2Cq%3A%3B&vjk=ec8c35dbe0b2a7ee

14 https://www.indeed.com/jobs?q=dollar+tree&l=Austin%2C+TX&sc=0fcckey%3A7d2afaa40240a56a%2Cq%3A%3B&vjk=7acf021e2ece7e9c

15 https://www.indeed.com/jobs?q=dollar+tree&l=manchester%2C+New+Hampshire&sc=0fcckey%3A7d2afaa40240a56a%2Cq%3A%3B&vjk=6a354d050a79d9fa

16 See generally, Burton G. Malkiel, A Random Walk Down Wall Street (2015).

17 Id.

18 29 USC Section 404(a)(1)(C).

19 See Uniform Prudent Investor Act, § 3 (“[a] trustee shall diversify the investments of the trust unless the trustee reasonably determines that, because of special circumstances, the purposes of the trust are better served without diversifying.”)

| 4 |

| 2. | The performance of a diversified portfolio largely depends on overall market return. |

Diversification is thus required by accepted investment theory and imposed by law on investment fiduciaries. Once a portfolio is diversified, the most important factor determining return will not be how the companies in that portfolio perform relative to other companies (“alpha”), but rather how the market performs as a whole (“beta”). In other words, the financial return to such diversified investors chiefly depends on the performance of the market, not the performance of individual companies. As one work describes this, “[a]ccording to widely accepted research, alpha is about one-tenth as important as beta [which] drives some 91 percent of the average portfolio’s return.”20 As shown in the next section, the social and environmental impacts of individual companies such as Dollar Tree can have a significant impact on beta.

| 3. | Costs companies impose on social and environmental systems heavily influence beta. |

Over long time periods, beta is influenced chiefly by the performance of the economy itself, because the value of the investable universe is equal to the portion of the productive economy that the companies in the market represent.21 Over the long run, diversified portfolios rise and fall with GDP or other indicators of the intrinsic value of the economy. As investor Warren Buffet puts it, GDP is the “best single measure” for broad market valuations.22

But the social and environmental costs created by companies pursuing profits can burden the economy. For example, research reveals that income inequality and attendant racial and gender disparity harm the entire economy. According to the Economic Policy Institute, income inequality is slowing U.S. economic growth by reducing demand by 2-4%.23 Similarly, the Federal Reserve Bank of San Francisco determined that gender and racial gaps created $2.9 trillion in losses to U.S. GDP in 2019.24 Moreover, a recent report from Citigroup calculated that eliminating racial disparity would add $5 trillion to the U.S. economy over the next five years.25 The same study explains steps that corporations could take to reduce the gap. This drag on GDP directly reduces the return on a diversified portfolio over the long term.26

_____________________________

20 Stephen Davis, Jon Lukomnik, and David Pitt-Watson, What They Do with Your Money (2016).

21 Principles for Responsible Investment & UNEP Finance Initiative, Universal Ownership: Why Environmental Externalities Matter to Institutional Investors, Appendix IV, https://www.unepfi.org/fileadmin/documents/universal_ownership_full.pdf.

22 See, e.g., https://archive.fortune.com/magazines/fortune/fortune_archive/2001/12/10/314691/index.htm (total market capitalization to GDP “is probably the best single measure of where valuations stand at any given moment”).

23 Josh Bivens, Inequality is slowing U.S. economic growth: Faster wage growth for low- and middle-wage workers is the solution, Economic Policy Institute (December 12, 2017), available at https://www.epi.org/publication/secular-stagnation/.

24 Shelby R. Buckman et al., The Economic Gains from Equity, Federal Reserve Bank of San Francisco (January 19, 2021), available at https://www.frbsf.org/our-district/files/economic-gains-from-equity.pdf.

25 Dana M. Peterson and Catherine L. Mann, Closing the Racial Inequality Gaps: The Economic Cost of Black Inequality in the U.S., Citi GPS (September 2020), available at http://citi.us/3olxWH0.

26 Ibid 21.

| 5 |

The reduction in economic productivity caused by inequality and racial disparity thus directly reduces returns on diversified portfolios and creates serious social costs that further threaten financial markets. For example, excessive inequality can erode social cohesion and heighten political polarization, leading to social instability.27 It is also a social determinant of health that is linked to more chronic medical conditions developed earlier in life, thereby increasing health costs and decreasing the value of human capital.28

A recent U.S. Government Accountability Office report29 revealed how taxpayers foot the bill when corporations underpay their workers. Millions of full-time workers rely on federal health care and food assistance programs just to get by, and the wholesale and retail trade is in the top five industries with the highest concentration of working adults enrolled in Medicaid and SNAP.30 This, of course, is a form of corporate welfare, in that taxpayers – and, by extension, shareholders – are subsidizing employers who pay low wages.

The acts of individual companies affect whether the economy will bear these costs: if they increase their own bottom line by contributing to inequality, the profits earned for and capital returned to their shareholders may be inconsequential in comparison to the added costs the economy bears.

Economists have long recognized that profit-seeking firms will not account for costs they impose on others, and there are many profitable strategies that harm stakeholders, society and the environment.31 Indeed, in 2018, publicly listed companies around the world imposed social and environmental costs on the economy to the tune of $2.2 trillion annually – more than 2.5%of global GDP.32 This cost was more than 50% of the profits those companies reported.

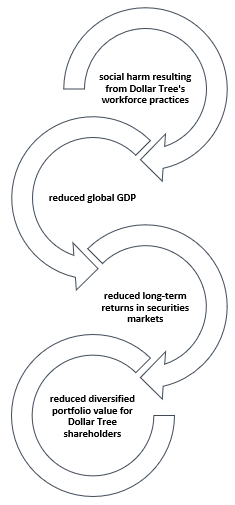

As shown below in Figure 1, Dollar Tree’s choices that contribute to a financially insecure labor force threaten its diversified shareholders’ financial returns, even if those decisions might benefit Dollar Tree financially.

_____________________________

27 International Monetary Fund, IMF Fiscal Monitor: Tackling Inequality (October 2017), available at https://www.imf.org/en/publications/fm/issues/2017/10/05/fiscal-monitor-october-2017.

28 Anne Matusewicz and Henry Mason, Facing hard truths: The material risk of rising inequality, Pensions & Investments, available at https://www.pionline.com/sponsored-content/facing-hard-truths-material-risk-rising-inequality.

29 United States Government Accountability Office, Federal Social Safety Net Programs: Millions of Full-Time Workers Rely on Federal Health Care and Food Assistance Programs (October 202), available at https://www.gao.gov/assets/gao-21-45.pdf.

30 Ibid.

31 See, e.g., Kaushik Basu, Beyond the Invisible Hand: Groundwork for a New Economics 10 (2011) (explaining the First Fundamental Theorem of Welfare Economics as the strict conditions (including the absence of externalities) under which competition for profit produces optimal social outcomes).

32 Andrew Howard, SustainEx: Examining the social value of corporate activities, (Schroders 2019), available at https://www.schroders.com/en/sysglobalassets/digital/insights/2019/pdfs/sustainability/sustainex/sustainex-short.pdf.

| 6 |

Figure 1

| 4. | Dollar Tree could mitigate the costs it externalizes by paying a living wage. |

A living wage, while no panacea, would at least provide the minimum income necessary for Dollar Tree’s workers to meet their most basic needs.

A living wage commitment would benefit women and people of color the most, as these two groups make up the majority of Dollar’s Tree employee base. In 2021, Dollar Tree New Hires were 65.7% (female) and 60.2% (People of Color)33.

| 5. | Dollar Tree asserts that it pays “competitive” wages. |

In Dollar Tree’s statement of opposition, it states that the company provides competitive pay and benefits for associates. However, this response misses the point of the proposal, which focuses on the impact of compensation practices from a systematic risk perspective. We do not dispute that Dollar Tree has implemented significant measures to improve employee pay. However, this framing completely ignores the fact that “competitive” pay means little to an employee who must still rely on Medicaid and SNAP benefits just to put food on the table and house and clothe their children. “Competitive” pay confers limited value if the entire industry underpays, as this one does.

_____________________________

33 https://corporate.dollartree.com/_assets/_2887c8708450491011bd139ee46c6fe0/dollartreeinfo/db/1177/9112/pdf/Corporate_Sustainability_Report.pdf

| 7 |

| A. | Conclusion |

Please vote “FOR” Item 5

By voting “FOR” Item 5, shareholders can urge Dollar Tree to account directly for its effect on the labor force, upon which a thriving economy depends. Such a report can aid the Board and management in authentically addressing the public need to constrain income inequality while supporting the interests of its shareholders.

United Church Funds urges you to vote “FOR” Item 5 on the proxy, the Shareholder Proposal requesting a report on external costs of Dollar Tree’s compensation and workforce practices at the Dollar Tree Co. Annual Meeting on June 13, 2023

For questions regarding the Dollar Tree Co. Proposal please contact Matthew Illian of United Church Funds via email at matthew.illian@ucfunds.org.

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO SHAREHOLDERS VIA TELEPHONE, U.S. MAIL, E-MAIL, CERTAIN WEBSITES, AND CERTAIN SOCIAL MEDIA VENUES AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR AS A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY.

PROXY CARDS WILL NOT BE ACCEPTED BY FILER NOR

BY UNITED CHURCH FUNDS.

TO VOTE YOUR PROXY, PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

8